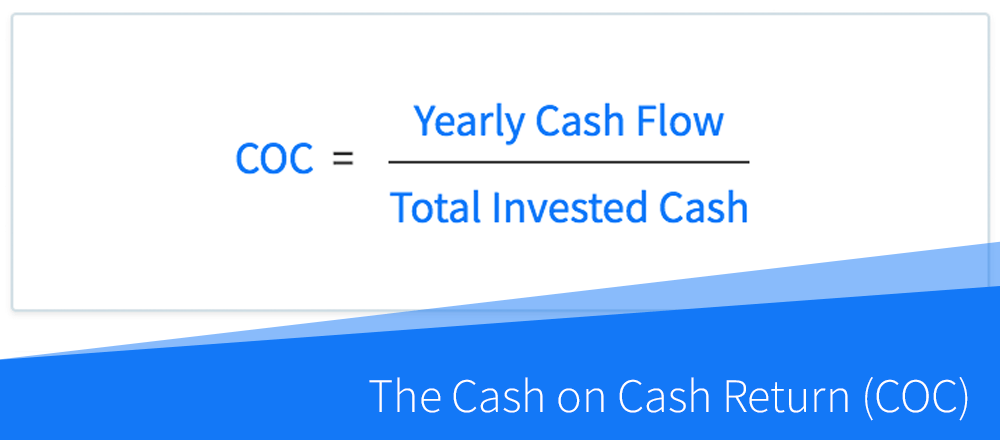

Cash on cash roi formula

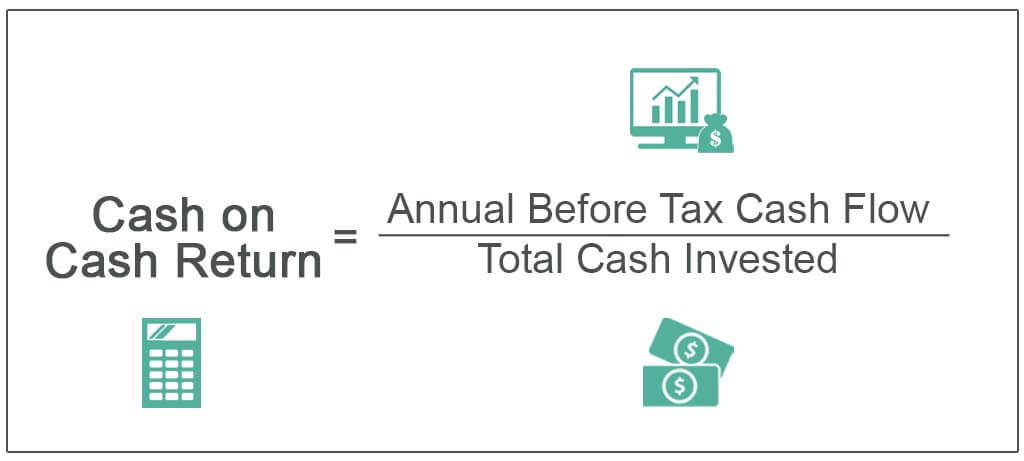

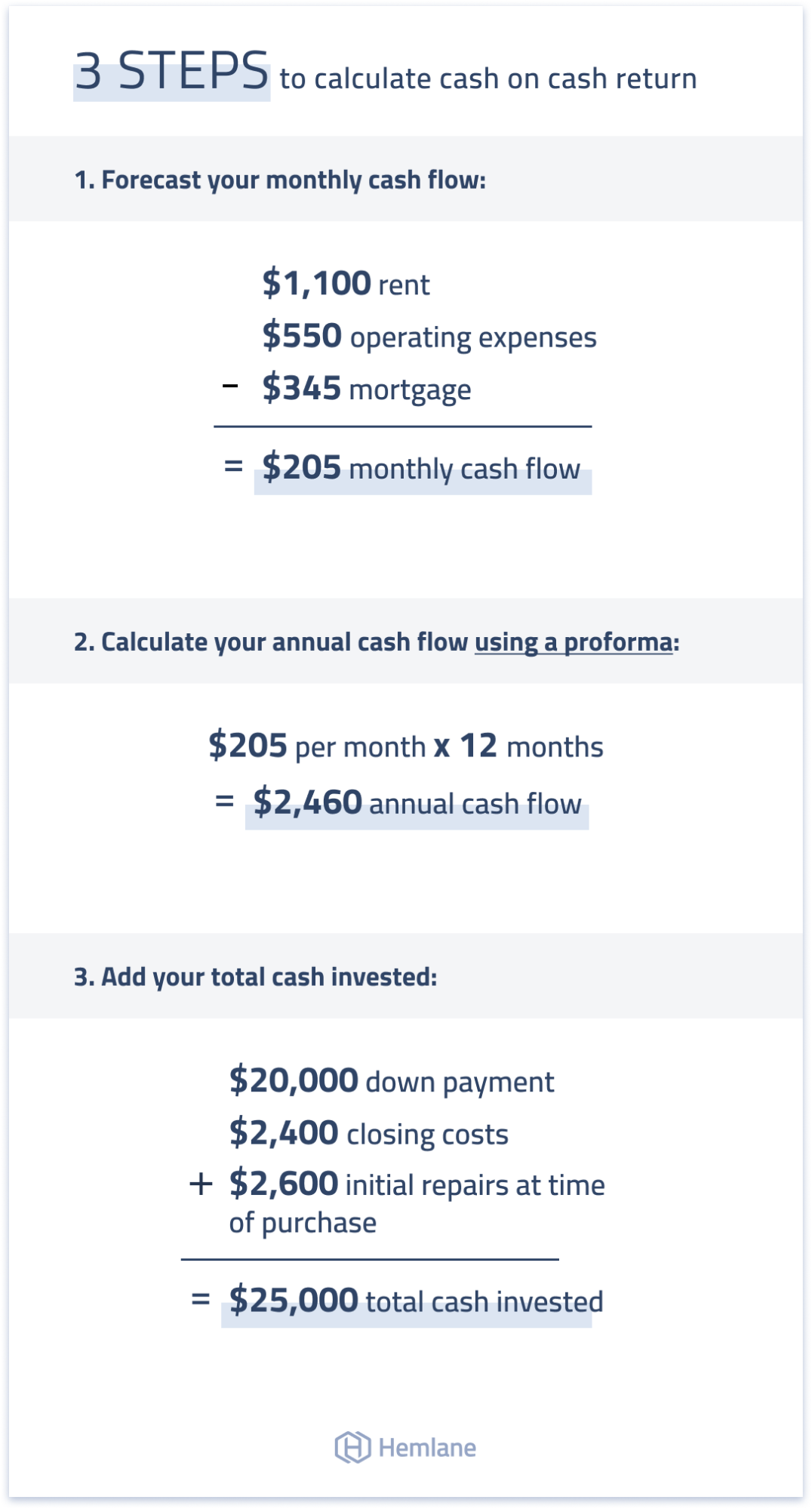

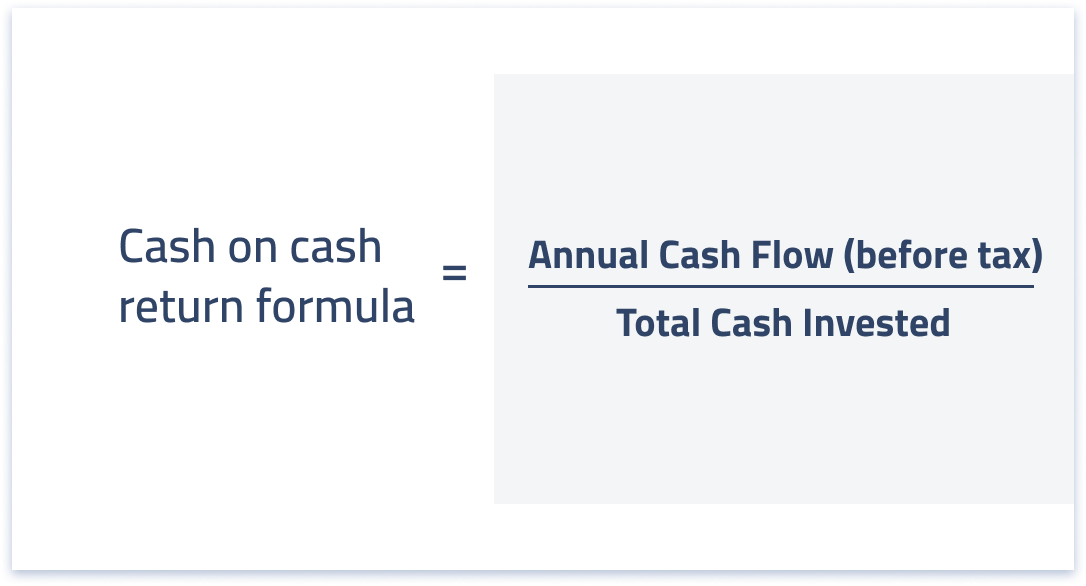

Heres an example of how the cash-on-cash return calculator works. Cash on Cash Return Annual Pre-Tax Cash Flow Actual Cash Invested x 100.

Cash On Cash Return A Beginner S Guide Propertymetrics

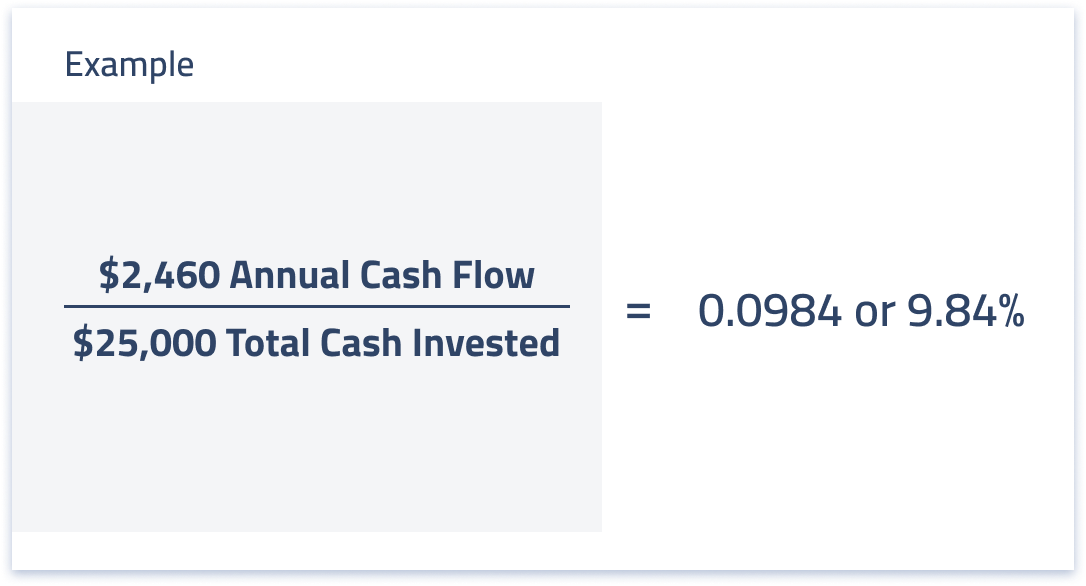

Cash on Cash Formula Example.

. Cash-on-cash return is a rate of return often used in real estate transactions that calculates the cash income earned on the cash invested in a property. To determine the CoC return first calculate the amount of pretax cash flow rent minus debt service. Cash Flow monthly income -.

This figure should be compared. The company takes 52 days to turn its investment into its inventory back into cash. Thus Cash on Cash Return 48000500000 96.

The cash-on-cash return formula only requires the value of the investors cash investment and the annual income of the investment property. This includes mortgage payments utilities repairs and down payment. The formula for cash on cash return is reasonably simple you divide.

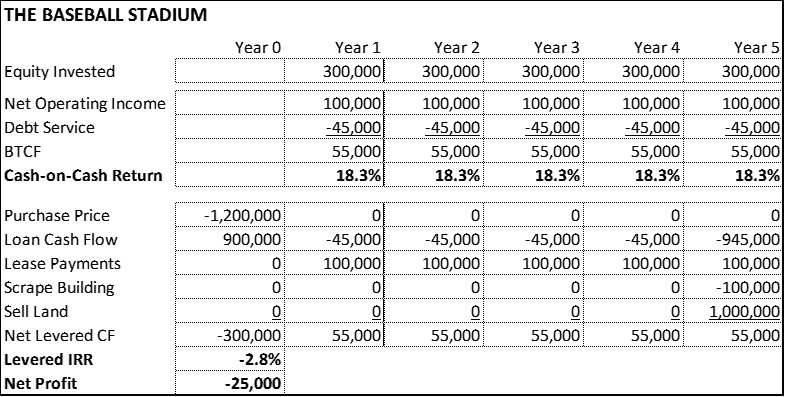

Lets say you invest 80000 in the property. In the examples above the loan increased this ratio. Once we have identified the total cash outlay and annual cash flow of the asset we will use the cash on cash return formula.

1 Formula for Cash on Cash Return. Loans or leverage increases the risk for the investor. The cash conversion cycle is therefore 73 156 365 521.

Return On Investment ROI The cash-on-cash return statistic varies from ROI in that ROI is concerned with overall profitability how much total gain or loss the. Guide to what is Levered Free Cash Flow its meaning. Closing costs Property value 005 9750.

Now cash flow yearly cash flow monthly 12. This is sometimes called the monetary return on investment in property. Lauren started a firm called ABC Ltd.

A cash on cash returnor cash yieldis a type of return rate used to assess the annual return that an investor will make on an investment property compared to the amount of. Any damage extra costs. For example when an.

Cash on Cash Return vs Return on Investment. The expected first year of annual income of the. In real estate investing the return on investment ROI indicates the overall profitability of a rental property.

Then divide that by the amount of cash initially invested. The terms cash on cash return and return on investment ROI are often used interchangeably leaving people wondering what the difference is between the two. Continuing the previous example if you earned 800 for the year and paid the principal balance on your rental property loan.

We explain its formula calculation example differences from operating cash flow. Cash on cash return is a measure usually used to assess the effectiveness of a commercial real estate investment. So the total cost to acquire the property.

This cash-on-cash return formula looks like this.

How To Calculate The Cash On Cash Return Coc In Real Estate Dealcheck Blog

What Is Cash On Cash Return Infographic Mashvisor

Cash On Cash Return Calculate Cash On Cash Return In Real Estate

Why Cash On Cash Return Matters To Real Estate Investors In 2021

![]()

What Is Opm Retipster Com

Cash On Cash Return Definition

Why Cash On Cash Return Matters To Real Estate Investors In 2021

How To Calculate Cash On Cash Return For Your Cre Property Leverage Com

Cash On Cash Return Formula Excel Example Zilculator Real Estate Analysis Marketing

Cash On Cash Equity Multiple Irr Cold Smoke Investments

Cash On Cash Return What Is Good In Real Estate Mashvisor

What Is A Good Cash On Cash Return Lofty Real Estate Blog

Why Cash On Cash Return Matters To Real Estate Investors In 2021

Real Estate Cash On Cash Return

6 Steps To A 10 Cash On Cash Return And 18 Total Return Sportofmoney Com

Cash On Cash Return A Beginner S Guide Propertymetrics

Using The Cash On Cash Return In Real Estate Analysis A Cre